Understanding ACORD 35: The Foundation for Streamlined Policy Cancellations

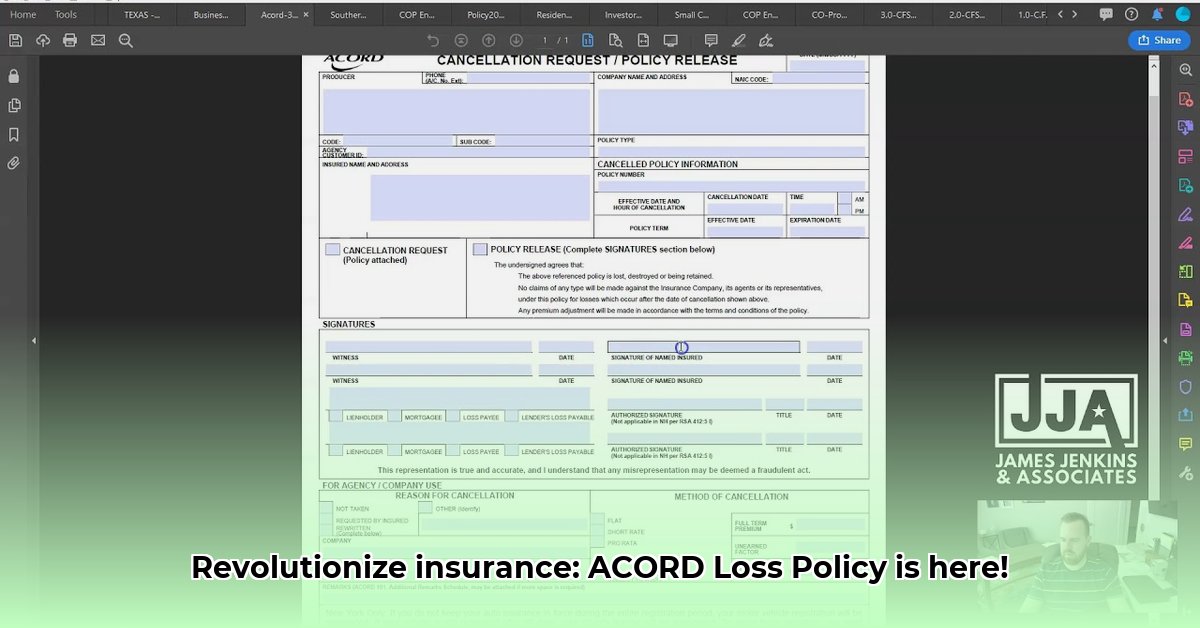

The insurance industry often struggles with inefficient policy cancellation processes. However, ACORD Form 35 offers a standardized solution, revolutionizing how insurers, policyholders, and InsurTech providers manage policy releases. This form acts as a universal translator, ensuring clear communication and minimizing errors stemming from disparate systems and processes. By establishing a common data format, ACORD 35 significantly reduces delays and streamlines workflows, ultimately improving efficiency and customer satisfaction. But how can you effectively leverage this powerful tool?

Implementing ACORD 35: A Practical Guide for InsurTech Integration

Integrating ACORD 35 into your existing infrastructure requires a strategic approach. Here's a step-by-step guide to ensure a smooth and effective implementation:

Data Mapping (Critical): Before implementation, meticulously map your existing system's data fields to the corresponding fields within the ACORD 35 form. Accuracy is paramount; inconsistencies here will create downstream problems. This step ensures seamless data transfer and minimizes errors.

Automation for Efficiency: Leverage automation tools to streamline the creation, transmission, and reception of ACORD 35 forms. This significantly reduces manual effort and accelerates processing times. Workflow automation platforms can greatly enhance this phase.

Robust Validation and Error Checking: Incorporate rigorous validation checks into your workflow to ensure data completeness and accuracy. This step mitigates errors and prevents delays caused by incomplete or inaccurate information.

Secure Data Storage and Compliance: Store electronic ACORD 35 forms securely, adhering strictly to all relevant data privacy regulations such as GDPR and CCPA. Data security is non-negotiable.

Continuous Monitoring and Optimization: Track key metrics related to the ACORD 35 implementation process. This data informs continuous improvement efforts, revealing areas for optimization and potential bottlenecks.

"Data-driven decision making is crucial. By meticulously tracking key performance indicators, we can identify areas for improvement and continuously optimize our ACORD 35 implementation," says Sarah Chen, CTO at InsurTech Solutions.

Best Practices and Troubleshooting Common Challenges

Successfully integrating ACORD 35 requires careful planning and attention to detail. Here are several best practices and solutions to common challenges:

Invest in Modern Technology: Upgrading existing systems may be necessary for seamless integration. Don't hesitate to invest in the appropriate tools and technologies.

Prioritize Data Security: Robust security measures are essential to protect sensitive customer data. This includes adhering to all relevant data security regulations.

Comprehensive Documentation: Maintain thorough documentation to support troubleshooting and future audits. A detailed record of the implementation process is invaluable.

Common challenges include difficulties integrating with legacy systems and ensuring consistent data mapping across multiple systems. Proactive problem-solving and careful planning are crucial to mitigate these risks.

Case Study: [Insert Name of Company]’s Successful ACORD 35 Implementation

[Insert a brief case study detailing a successful implementation of ACORD 35, highlighting key benefits and strategies used.] This will demonstrate the tangible benefits of adopting this standardized form. The quantifiable results from this case study should reinforce the actionable insights provided in the article.

The Future of ACORD 35: Trends and Predictions

Looking ahead, we can expect several significant developments relating to ACORD 35:

Increased Automation: AI and machine learning will fuel further automation in policy cancellation processes, resulting in even greater efficiency gains.

Enhanced Integration: Expect better integration of ACORD 35 with other ACORD forms, creating a more holistic and integrated data ecosystem.

Evolving Regulatory Landscape: Changes in regulations will likely influence how ACORD 35 is implemented and utilized. Proactive monitoring of regulatory changes is crucial.

"We foresee a future where ACORD 35 becomes an integral part of a fully automated insurance ecosystem," notes David Miller, Principal Analyst at [Name of Research Firm]. "This will drive significant cost savings and improve the overall customer experience."

Isn't it time your organization embraced the potential of ACORD 35? The benefits of streamlined policy cancellation processes are clear, and the technological advancements on the horizon will only amplify these advantages. By proactively adopting this standard, you can position your business for greater efficiency and competitive advantage.